UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, For Use of the Commission Only (as permitted by 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional materials |

|

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

|

|

(Name of Registrant as Specified in Its Charter) |

|

|

|

Payment of filing fee (Check the appropriate box): |

|

|

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SKECHERS U.S.A., INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Stockholders to Be Held on Monday, May 23, 2024

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Skechers U.S.A., Inc., a Delaware corporation, to be held on Thursday, May 23, 2024 at 12:00 p.m. Pacific Time. This year’s Annual Meeting will be held solely virtually via the Internet at www.virtualshareholdermeeting.com/SKX2024. You will not be able to attend the Annual Meeting in person.

Our Annual Meeting is being held for the following purposes:

The Board of Directors has set the close of business on March 26, 2024 as the record date for determining those stockholders who will be entitled to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 23, 2024: The proxy statement and 2023 Annual Report are available in the SEC Filings section of the investor relations page of our corporate website at https://investors.skechers.com/financial-data/all-sec-filings and at www.proxyvote.com.

This year, we are continuing to take advantage of Securities and Exchange Commission rules that allow companies to furnish their proxy materials over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of our proxy materials, which include the Notice of Annual Meeting, our Proxy Statement, our 2023 Annual Report and a proxy card or voting instruction form. The Notice contains instructions on how to access those documents on the Internet and how to cast your vote via the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials. All stockholders who do not receive the Notice will receive a paper copy of the proxy materials by mail. If you receive a paper copy of our proxy materials, you can cast your vote by completing the enclosed proxy card and returning it in the postage-prepaid envelope provided, or by utilizing the telephone or Internet voting systems. Returning a signed proxy card or submitting a proxy over the Internet or by telephone will not affect your right to vote at the virtual Annual Meeting. Please submit your proxy promptly to avoid the expense of additional proxy solicitation.

You are cordially invited to attend the Annual Meeting virtually, and if you plan to attend the Annual Meeting you must log in to www.virtualshareholdermeeting.com/SKX2024 using the 16-digit control number on the Notice, proxy card or voting instruction form that accompanied the proxy materials.

|

FOR THE BOARD OF DIRECTORS |

|

|

|

Philip G. Paccione, Corporate Secretary |

Dated: April 11, 2024 |

|

Manhattan Beach, California |

|

SKECHERS U.S.A., INC.

PROXY STATEMENT

For Annual Meeting of Stockholders to be Held

May 23, 2024 at 12:00 p.m. Pacific Time

This proxy statement is delivered to you by Skechers U.S.A., Inc., a Delaware corporation (“we,” “us,” “our,” “our company” or “Skechers”), in connection with our Annual Meeting of Stockholders to be held on May 23, 2024 at 12:00 p.m. Pacific Time (the “Annual Meeting”). The Annual Meeting will be held solely virtually via the Internet at www.virtualshareholdermeeting.com/SKX2024. The Board of Directors of Skechers (the “Board”) is soliciting proxies to be voted at the Annual Meeting.

As permitted by the Securities and Exchange Commission (“SEC”), Skechers is providing most stockholders with access to our proxy materials over the Internet rather than in paper form. Accordingly, on or about April 11, 2024, we will mail to most stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the proxy materials over the Internet and mail printed copies of the proxy materials to the rest of our stockholders. If you receive the Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in our Proxy Statement and our 2023 Annual Report to Stockholders. The Notice also instructs you on how to submit your proxy via the Internet. If you receive the Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

YOUR VOTE IS VERY IMPORTANT.

If a proxy is duly granted and returned over the Internet, by telephone or by mailing a proxy card in the accompanying form, the shares represented by the proxy will be voted as directed. If no direction is given, the shares represented by the proxy will be voted FOR the election of the nominees for director named herein and AGAINST the stockholder proposal. Any proxy given pursuant to this solicitation may be revoked at any time prior to its exercise by notifying our Corporate Secretary, Philip Paccione, in writing of such revocation, by duly executing and delivering another proxy bearing a later date, by submitting another proxy by telephone or via the Internet (your latest telephone or Internet voting instructions are followed) or by attending and voting at the virtual Annual Meeting. If your shares are held in street name and you want to change your vote, please contact your broker, bank or other nominee to find out how to do so. We will incur the cost of this solicitation of proxies. In addition, our officers and other regularly engaged employees may, in a limited number of instances, solicit proxies. We will reimburse banks, brokerage firms, other custodians, nominees and fiduciaries for reasonable expenses incurred in sending proxy materials to beneficial owners of our Class A Common Stock and Class B Common Stock.

Shares Outstanding and Quorum

Holders of our Class A Common Stock and Class B Common Stock of record at the close of business on March 26, 2024 will be entitled to vote at the Annual Meeting. There were 135,954,976 shares of Class A Common Stock and 20,181,683 shares of Class B Common Stock outstanding on that date. Each share of Class A Common Stock is entitled to one vote and each share of Class B Common Stock is entitled to ten votes, the shares of Class A Common Stock and Class B Common Stock vote together as a single class on all matters upon which stockholders have the right to vote, and the presence virtually or by proxy of holders of a majority of the combined voting interest of the outstanding shares of Class A Common Stock and Class B Common Stock is necessary to constitute a quorum for the Annual Meeting. A quorum must be established to consider any matter. Your shares will be accounted as

present at the Annual Meeting if you are present at the virtual Annual Meeting or have properly submitted a proxy card by mail or submitted a proxy by telephone or over the Internet.

How You Can Vote

You may vote by attending the Annual Meeting and voting at the virtual meeting or you may vote by submitting a proxy. If you are the record holder of your stock, you may vote by submitting your proxy via the Internet, by telephone or through the mail.

To vote via the Internet, follow the instructions on the Notice or go to the Internet address stated on your proxy card. To vote by telephone, call the number on your proxy card. If you receive only the Notice, you may follow the procedures outlined in the Notice to request a proxy card.

As an alternative to voting by telephone or via the Internet, you may vote by mail. If you receive only the Notice, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail. If you receive a paper copy of the proxy materials and wish to vote by mail, simply mark your proxy card, date and sign it and return it in the postage-prepaid envelope. If you do not have the postage-prepaid envelope, please mail your completed proxy card to the following address: Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

If you hold your shares of our Class A Common Stock in street name you will receive the Notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or other nominee will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of our Proxy Statement and proxy card by following the instructions on the Notice provided by your broker, bank or other nominee.

The Internet and telephone voting facilities will close at 11:59 p.m., Eastern Time, on May 22, 2024. Stockholders who submit a proxy via the Internet should be aware that they may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by such stockholders. Stockholders who submit a proxy via the Internet or by telephone need not return a proxy card or the form forwarded by your broker, bank or other nominee by mail.

Attending and Voting at the Virtual Annual Meeting

The Annual Meeting will be held virtually via the Internet at www.virtualshareholdermeeting.com/SKX2024. You will not be able to attend the Annual Meeting in person.

Access to the Annual Meeting. The live audio webcast of the Annual Meeting will begin at 12:00 p.m. Pacific Time. Online access to the webcast will open approximately 30 minutes prior to the start of the Annual Meeting to allow time for our stockholders to log in and test their devices’ audio system. We encourage our stockholders to access the meeting in advance of the designated start time.

Log-in Instructions. Stockholders will need to log-in to www.virtualshareholdermeeting.com/SKX2024 using the 16-digit control number on the Notice, proxy card or voting instruction form to attend the Annual Meeting.

2

Submitting Questions at the Annual Meeting. Stockholders may submit questions and vote on the day of, or during, the Annual Meeting on www.virtualshareholdermeeting.com/SKX2024. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your Notice, proxy card or voting instruction form to submit questions and vote at our Annual Meeting. After the business portion of the Annual Meeting concludes and the meeting is adjourned, we will hold a Q&A session during which we intend to answer questions submitted during the meeting that are pertinent to Skechers and that are submitted in accordance with the Rules of Conduct for the Annual Meeting, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be answered only once. To promote fairness, efficient use of our resources and ensure all stockholder questions are able to be addressed, we will respond to no more than three questions from a single stockholder.

Technical Assistance. Beginning 30 minutes prior to the start of and during the virtual Annual Meeting, we will have support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log-in page at www.virtualshareholdermeeting.com/SKX2024.

Voting shares prior to and at the virtual Annual Meeting. Stockholders may vote their shares at www.proxyvote.com prior to the day of the virtual Annual Meeting or at www.virtualshareholdermeeting.com/SKX2024 on the day of and during the virtual Annual Meeting. If you are a beneficial owner, you must submit a legal proxy from your broker or other nominee as the record holder and a letter from your broker or other nominee showing that you were the beneficial owner of your shares on the Record Date.

Counting of Votes

Pursuant to Proposal No. 1, the two candidates for director receiving the most “For” votes of the votes entitled to be voted at the Annual Meeting will become directors of Skechers. Because directors are elected by a plurality of the votes cast, a “Withhold” vote as to Proposal No. 1 will not have any effect on the election of directors as long as one vote is cast for each director nominee. Stockholders may not cumulate their votes. Proposal No. 2 is a stockholder proposal requesting our company to publicly disclose a timeline for measuring and disclosing our value chain emissions. Proposal No. 2 will be considered as having passed if it receives the affirmative “For” vote of a majority of voting interest of the shares of Class A Common Stock and Class B Common Stock virtually present or represented by proxy and entitled to vote on each such proposal at the Annual Meeting. Proxies marked “Abstain” as to Proposal No. 2 will have the same effect as a vote cast against it.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. With respect to our 2024 Annual Meeting, brokers are not permitted to vote on either of Proposal Nos. 1 and 2 without instructions from the beneficial owner. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting and will not be counted in determining whether there is a quorum.

3

Householding

The SEC has adopted rules that permit companies and intermediaries such as banks and brokers to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. This year, a number of banks and brokers with account holders who are our stockholders will be householding our proxy materials. A single proxy statement or Notice will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your bank or broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive separate copies of our Notice or proxy statement and annual report, please notify your bank or broker, direct your written request to Investor Relations, Skechers U.S.A., Inc., 228 Manhattan Beach Boulevard, Manhattan Beach, California 90266, or contact our investor relations advisory firm, Addo Communications, by telephone at (310) 829-5400. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of their communications should contact their bank or broker.

Our principal executive office is located at 228 Manhattan Beach Boulevard, Manhattan Beach, California 90266.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes, with each director serving a three-year term and until their successors is duly elected and qualified or until their death, resignation or removal. One class of directors is elected annually at our annual meeting of stockholders. Our bylaws provide for a variable Board of Directors with between five and eleven members. We currently have eight members on our Board of Directors. Our bylaws give the Board of Directors the authority to increase or decrease the number of directors without the approval of our stockholders, and our bylaws also give our stockholders the authority to increase or decrease the size of our Board of Directors. The nominees for election to our Board of Directors at our 2024 Annual Meeting of Stockholders are Robert Greenberg and Morton Erlich. For more information regarding our nominees, please see “Information Concerning Director Nominees” below.

Unless otherwise directed by stockholders, within the limits set forth in our bylaws, the proxy holders will vote all shares represented by proxies held by them for the election of Robert Greenberg and Morton Erlich, who are director nominees and are currently members of the Board of Directors. We have been advised by Robert Greenberg and Morton Erlich of their availability and willingness to serve if re-elected. In the event that either of Robert Greenberg or Morton Erlich becomes unavailable or unable to serve as a member of the Board of Directors prior to the voting, the proxy holders will refrain from voting for them or will vote for a substitute nominee in the exercise of their best judgment.

The Board of Directors recommends a vote FOR each of these director nominees.

5

PROPOSAL NO. 2

STOCKHOLDER PROPOSAL REQUESTING OUR COMPANY TO PUBLICLY DISCLOSE A TIMELINE FOR MEASURING AND DISCLOSING OUR VALUE CHAIN EMISSIONS

As You Sow, on behalf of the Laird Norton Family Foundation, which is a beneficial owner of at least $25,000 worth of our Class A Common Stock, submits the following resolution to stockholders for approval at the Annual Meeting, if properly presented. We will provide the proponents’ share ownership and address, as available, to any stockholder promptly upon request to our General Counsel by calling 310-318-3100 or sending a request to Skechers U.S.A., Inc., 228 Manhattan Beach Boulevard, Manhattan Beach, California 90266. The text of the proponents’ resolution and supporting statement appear below, printed verbatim from its submission. We disclaim all responsibility for the content of the proposal and the supporting statement, including sources referenced therein.

WHEREAS: The Intergovernmental Panel on Climate Change reports that immediate and significant emissions reductions are required of all market sectors to stave off the worst consequences of climate change.1In response to the climate crisis, investors are seeking transparent climate-related risk disclosures from companies, including greenhouse gas (GHG) emissions disclosures, to inform their investment decision-making.

Skechers USA, Inc. is one of the largest footwear brands in the world.2 According to the United Nations Environment Program, the fashion industry accounts for roughly ten percent of global carbon dioxide emissions.3 As much as 96% of the total emissions of fashion brands come from their value chain,4 and, as McKinsey notes, supply chain decarbonization is becoming a reputational imperative for businesses.5

Supply chain disruptions are one of the largest climate-related risks facing retailers, and the National Retail Federation warns that companies who do not address supply chain climate risk “potentially face significant losses.”6 Despite identifying climate risks, including impacts from “natural disasters or other catastrophic events” on its supply chain, as a material risk to the Company’s business,7 Skechers does not disclose value chain, or Scope 3, GHG emissions, and has no emissions reductions targets.8

Skechers significantly lags nearly all its major competitors in addressing climate risk. Deckers Brands, Puma, Adidas, Nike, Under Armour, and VF Corporation have all set reduction targets for their value chain emissions and validated these targets through the Science Based Targets initiative.9 While Skechers states that it has plans to “begin undertaking efforts” to measure value chain emissions “in the future,”10 it has released no timeline for its efforts to measure and disclose value chain emissions, leaving investors without critical information regarding the Company’s efforts to mitigate climate risk.

By publicly releasing a timeline for measuring and disclosing its value chain emissions, Skechers can align with peers and assure investors that it is addressing the growing regulatory, competitive, and physical supply chain risks associated with climate change.

RESOLVED: Shareholders request Skechers publicly disclose a timeline for measuring and disclosing its value chain emissions.

SUPPORTING STATEMENT:

Proponents suggest, at management's discretion, the Company:

• Provide a rationale and threshold criteria for determining if any emissions categories are deemed to be not relevant; and

• Provide annual public updates on the Company’s efforts to quantify its value-chain emissions, including information on efforts to engage with its suppliers.

6

7

BOARD OF DIRECTORS OPPOSITION STATEMENT

The Board of Directors has carefully considered the proponents’ proposal and believes that its general requirements are already addressed in Skechers’ Impact Report, first published in 2023. This report, which is available in the Impact Section of the Investors Relations page of our corporate information website located at https://about.skechers.com/social-responsibility/, clearly articulates our environmental, social and governance (“ESG”) priorities as well as estimates of our scope 1 and 2 greenhouse gas emissions for 2020 and 2021. In 2024, Skechers plans to publish its second Impact Report, providing updates to our ESG priorities as well as estimates of our scope 1 and 2 greenhouse gas emissions for 2022 and 2023. Further, this updated report will reflect our efforts to complete a global double-materiality assessment, in order to ascertain the relevance of ESG-related topics to our company’s stakeholders.

As we stated last year, Skechers will continue to strive for meaningful, enduring change that will be impactful to our customers, employees, communities, and stockholders. We are supportive of the footwear and apparel industry’s efforts to responsibly steward our business and our environmental impact. However, we do not believe the proponents’ proposal is necessary in light of our published Impact Report or in the best interest of our ESG objectives.

The Board of Directors recommends a vote AGAINST the shareholder proposal requesting our company to publicly disclose a timeline for measuring and disclosing our value chain emissions.

8

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

For each director nominee and director, set forth below is his or her name, age, tenure as a director of our company, and a description of his or her principal occupation, other business experience, public company and other directorships held during the past five years. The specific experiences, qualifications, attributes and skills that led the Board of Directors to conclude that each nominee should serve as a director at this time are described below.

Information Concerning Director Nominees

Name |

|

Age |

|

Class and Year |

|

Position |

Robert Greenberg |

|

84 |

|

Class I (2027) |

|

Chairman of the Board and |

|

|

|

|

|

|

Chief Executive Officer |

Morton Erlich |

|

79 |

|

Class I (2027) |

|

Director |

Robert Greenberg has served as our Chairman of the Board and Chief Executive Officer since October 1993.

Mr. Greenberg is uniquely qualified to serve on and lead our Board of Directors with over 40 years of experience in the footwear industry, primarily in branding and product design, including over 30 years as our founder, leader and one of our largest stockholders since our inception in 1992.

Morton Erlich has served as a member of our Board of Directors since January 2006 and has been an independent investor and consultant since October 2004. From October 2013 to March 2024, Mr. Erlich served as a member of the board of directors of American Vanguard Corporation. Mr. Erlich worked for 34 years at KPMG LLP including 24 years as an audit partner until retiring in September 2004. His last position at KPMG LLP was Managing Partner of the office in Woodland Hills, California. Mr. Erlich is currently a member of the Board of Governors of the City of Hope.

Mr. Erlich’s qualifications to serve on our Board include 34 years of accounting and finance experience at KPMG LLP and being licensed as a certified public accountant in California since 1974. His license has been inactive since 2006. While a partner with KPMG LLP, Mr. Erlich served as lead audit partner for numerous companies in a variety of industries including companies in consumer markets, manufacturing, distribution and retail sectors. His accounting and finance experience includes expertise with various types of transactions such as bank lines of credit, debt financings, equity financings including public offerings, and mergers and acquisitions.

Directors Not Standing for Election

The members of the Board of Directors who are continuing and not standing for election at this year’s Annual Meeting are set forth below.

Name |

|

Age |

|

Class and Year |

|

Position |

Michael Greenberg |

|

61 |

|

Class II (2025) |

|

President and Director |

David Weinberg |

|

73 |

|

Class II (2025) |

|

Chief Operating Officer, Executive Vice President and Director |

Zulema Garcia |

|

50 |

|

Class II (2025) |

|

Director |

Katherine Blair |

|

54 |

|

Class III (2026) |

|

Director |

Yolanda Macias |

|

58 |

|

Class III (2026) |

|

Director |

Richard Siskind |

|

78 |

|

Class III (2026) |

|

Director |

Michael Greenberg has served as our President and a member of our Board of Directors since our company’s inception in 1992, and from June 1992 to October 1993, he served as our Chairman of the Board.

Mr. Greenberg’s qualifications to serve on our Board include over 35 years of experience in the footwear industry, specifically in sales, including his leadership as President of our company for over 30 years.

9

David Weinberg has served as our Chief Operating Officer since January 2006, as our Chief Financial Officer from September 2009 to November 2017 and from October 1993 to January 2006, and as Executive Vice President and a member of our Board of Directors since July 1998.

Mr. Weinberg’s qualifications to serve on our Board include over 30 years of experience in the footwear industry, specifically in finance and operations, including more than 20 years as our Chief Financial Officer and over 15 years as our Chief Operating Officer.

Zulema Garcia has served as a member of our Board of Directors since December 2021. She joined Herbalife in October 2019, serving as Senior Vice-President of Worldwide Spend Management since August 2023 and serving as Senior Vice-President of Internal Audit from October 2019 to August 2023. Prior to that, she worked at KPMG LLP for 24 years, including 11 years as an audit partner until September 2019. While at KPMG, she spent two years in the professional practice group in KPMG’s New York office focusing on a various accounting, audit and SEC reporting matters. She also served as Diversity Co-Partner Champion for KPMG’s Audit Practice in the United States and KPMG’s Diversity Advisory Group. Ms. Garcia currently serves on the Board of Trustees of Mount St. Mary’s University in Los Angeles. Ms. Garcia received her bachelor’s degree in business administration, with an emphasis in accounting, from Mount St. Mary’s University.

Ms. Garcia’s qualifications to serve on our Board include over 25 years of accounting and finance experience and being licensed as a certified public accountant in California and New York. As Senior Vice President of Internal Audit at Herbalife, her responsibilities included overseeing worldwide financial, operational, and IT internal audit activities for Herbalife. While at KPMG, Ms. Garcia provided financial statement audit, audit of internal control over financial reporting (SOX 404), performance improvement consulting, equity financings including initial public offerings, and mergers and acquisitions services to SEC registrants and private companies in a variety of industries including retail, consumer products, manufacturing, industrial, and biopharmaceutical products.

Katherine Blair has served as a member of our Board of Directors since May 2019. Ms. Blair has also served as a member of the board of directors of Impac Mortgage Holdings, Inc. since December 2019. Since April 2014, she has been a partner at Manatt, Phelps & Phillips, LLP in Los Angeles, and prior to that was a partner at K&L Gates LLP. Ms. Blair’s practice focuses on corporate, securities and transactional matters and advising executive officers, general counsel and directors on corporate governance, SEC reporting and compliance, public and private securities offerings, as well as mergers and acquisitions.

Ms. Blair is a member of the Board of Governors of the USC Institute of Corporate Counsel, previously serving as co-chair, and previously served as Chair of the Business Law Section of the Los Angeles County Bar Association and as an officer of the Corporations Committee of the Business Law Section of the California Lawyers Association. Ms. Blair holds an undergraduate degree from the University of California, San Diego and a J.D., cum laude, from Pepperdine University School of Law.

Ms. Blair’s qualifications to serve on our Board include over 25 years in practice as a corporate securities lawyer advising public companies, including corporate, governance, reporting and transactional matters.

Yolanda Macias has served as a member of our Board of Directors since April 2022. Since December 2020, Ms. Macias has been Chief Content Officer at Cineverse Corp. (Nasdaq:CNVS), formerly known as Cinedigm Entertainment Group (Nasdaq:CIDM), and from October 2013 to December 2020, she was an Executive Vice President at Cinedigm, where her responsibilities include acquiring global content rights for all distribution and streaming platforms and overseeing all digital and physical sales and marketing. Prior to 2013, Ms. Macias held various positions at Gaiam Inc., Vivendi Entertainment, which was a division of Universal Music Group, DirecTV, Inc., Technicolor and The Walt Disney Company. Ms. Macias currently serves on the Board of Directors and the Executive Committee of C5LA, which is a non-profit organization that helps under-resourced, high potential youth to enroll and to succeed in college. She also serves on the Advisory Board for The Digital Entertainment Group’s Canon Club, which is dedicated to supporting women in entertainment and technology. Ms. Macias received her Bachelor of Science degree in business administration with a concentration in finance from California State University, Northridge, and her Master of Business Administration degree from the J.L. Kellogg Graduate School of Management at Northwestern University.

10

Ms. Macias’ qualifications to serve on our Board include over 30 years of experience in the media and distribution sectors, establishing and executing content and sales strategies to facilitate the growth and success of companies and their shareholders in the entertainment, distribution, streaming and technology industries.

Richard Siskind has served as a member of our Board of Directors since June 1999. Since he founded R. Siskind & Company in 1991, Mr. Siskind has served as its Chief Executive Officer and a member of its board of directors. R. Siskind & Company is a business that purchases brand name men’s and women’s apparel and accessories and redistributes those items to off-price retailers. R. Siskind & Company also controls other companies that have licenses and distribution agreements for various brands.

Mr. Siskind’s qualifications to serve on our Board include over 45 years of experience as chief executive officer of various companies in the consumer retail sector, including four years as Chief Executive Officer and six years as a board member of Magic Lantern Group, a publicly traded apparel company, and over 30 years as founder, Chairman of the Board and Chief Executive Officer of R. Siskind & Company. Mr. Siskind’s experience with consumer retail businesses includes expertise with business planning, operations, finance, inventory control, acquisitions and licenses.

Executive Officers

The following table sets forth certain information with respect to our executive officers who are not also members of our Board of Directors. For information concerning Robert Greenberg, see “Information Concerning Director Nominees” above, and for information concerning Michael Greenberg and David Weinberg, see “Directors Not Standing for Election” above.

Name |

|

Age |

|

Position |

John Vandemore |

|

50 |

|

Chief Financial Officer |

Philip Paccione |

|

62 |

|

General Counsel, Corporate Secretary and |

Mark Nason |

|

62 |

|

Executive Vice President of Product Development |

John Vandemore has served as our Chief Financial Officer since November 2017. Previously, he served as Executive Vice President, Divisional Chief Financial Officer of Mattel, Inc., from 2015 until 2017, and he served as Chief Financial Officer and Treasurer of International Game Technology from 2012 until 2015. Prior to 2012, Mr. Vandemore held various positions at The Walt Disney Company, AlixPartners, Goldman Sachs, and PricewaterhouseCoopers. Since December 2016, Mr. Vandemore has served as a member of the board of directors of Inspired Entertainment. Mr. Vandemore earned a Bachelor of Business Administration degree with a major in Accountancy from the University of Notre Dame and a Master of Business Administration degree from the J.L. Kellogg Graduate School of Management at Northwestern University.

Philip Paccione has served as our Executive Vice President of Business Affairs since February 2000, as our Corporate Secretary since July 1998 and as our General Counsel since May 1998.

Mark Nason has served as our Executive Vice President of Product Development since March 2002. From January 1998 to March 2002, Mr. Nason served as our Vice President of Retail and Merchandising, and from December 1993 to January 1998, he served as our Director of Merchandising and Retail Development.

Robert Greenberg is the father of Michael Greenberg; other than the foregoing, no family relationships exist among any of our executive officers or directors.

11

Skills, Qualifications and Experience of Directors

The table below summarizes the key skills, qualifications and experience that the Board of Directors considered for each director nominee and each director continuing to serve on our Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

Director |

|

Leadership |

|

Industry |

|

Finance/Risk |

|

Corporate |

|

Digital/ |

|

Marketing |

|

Diversity |

Katherine Blair |

|

● |

|

|

|

● |

|

● |

|

|

|

|

|

● |

Morton Erlich |

|

● |

|

|

|

● |

|

● |

|

|

|

|

|

|

Zulema Garcia |

|

● |

|

|

|

● |

|

● |

|

|

|

|

|

● |

Michael Greenberg |

|

● |

|

● |

|

|

|

|

|

● |

|

● |

|

|

Robert Greenberg |

|

● |

|

● |

|

|

|

|

|

|

|

● |

|

|

Yolanda Macias |

|

● |

|

|

|

● |

|

|

|

● |

|

● |

|

● |

Richard Siskind |

|

● |

|

● |

|

|

|

|

|

|

|

● |

|

|

David Weinberg |

|

● |

|

● |

|

● |

|

|

|

● |

|

|

|

|

12

CORPORATE GOVERNANCE AND BOARD MATTERS

Board of Directors, Committees of the Board and Attendance at Meetings

Our Corporate Governance Guidelines were adopted by our Board of Directors as of April 28, 2004 to assist the Board in the exercise of its responsibilities. The Corporate Governance Guidelines reflect the Board’s commitment to monitor the effectiveness of policy and decision making both at the Board and management levels, with a view to enhancing long-term stockholder value. The Corporate Governance Guidelines are posted in the Corporate Governance section of the Investor Relations page of our corporate information website located at https://investors.skechers.com/corporate-governance/governance-documents. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this proxy statement.

Our Board of Directors met five times in 2023, and all directors attended at least 75% of the combined total of (i) all Board meetings and (ii) all meetings of committees of the Board on which the director served. While we do not have a policy requiring our directors to attend our Annual Meeting of Stockholders, all directors attended the Annual Meeting of Stockholders held in 2023.

The Board has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The table below provides current membership and meeting information for 2023 for each of the committees. Each of the members of these committees is independent as defined by Section 303A of the New York Stock Exchange (“NYSE”) Listed Company Manual (collectively, the “NYSE Rules”), and each member of the Audit Committee is independent as defined by Section 10A(m)(3) of, and Rule 10A-3(b) under, the Exchange Act.

Name |

|

Audit |

|

Compensation |

|

Nominating and |

Katherine Blair |

|

|

|

● |

|

† |

Morton Erlich |

|

† |

|

● |

|

|

Zulema Garcia |

|

● |

|

|

|

● |

Yolanda Macias |

|

|

|

|

|

● |

Richard Siskind |

|

● |

|

† |

|

|

Total Meetings in 2023 |

|

7 |

|

7 |

|

2 |

† Committee Chairperson

Each of these committees acts under a written charter that complies with the applicable NYSE Rules and SEC rules. The functions performed by the committees are summarized below and are set forth in greater detail in their respective charters. The complete text of the charter for each committee can be found in the Corporate Governance section of the Investor Relations page of our corporate information website located at https://investors.skechers.com/corporate-governance/governance-documents, and copies are available in print, without charge, upon written request to our Corporate Secretary at Skechers U.S.A., Inc., 228 Manhattan Beach Boulevard, Manhattan Beach, California 90266. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this proxy statement.

Director Independence

Our Board of Directors, consisting of eight members, has affirmatively determined that five of its members are independent as defined by Section 303A.02 of the NYSE Rules. These directors are Katherine Blair, Morton Erlich, Zulema Garcia, Yolanda Macias and Richard Siskind. The Board of Directors made this affirmative determination regarding these directors’ independence based on discussions with the directors and on its review of the directors’ responses to a questionnaire regarding employment and compensation history; affiliations, family and other relationships; and transactions with our company, its subsidiaries and affiliates. The Board considered relationships and transactions between each director or any member of his or her immediate family and our company and its subsidiaries and affiliates, as reported in the section entitled “Transactions with Related Persons” in this proxy statement. The purpose of the Board of Director’s review with respect to each director was to determine

13

whether any such relationships or transactions were inconsistent with a determination that the director is independent under the NYSE Rules.

Board Leadership Structure

Robert Greenberg currently serves as both Chairman of the Board and Chief Executive Officer of our company. We believe combining the roles of Chairman and Chief Executive Officer is currently the appropriate leadership model for our company as it provides for clear accountability and efficient and effective leadership of our business. Mr. Greenberg’s knowledge regarding our operations and the industries and markets in which we compete positions him to best identify matters for Board review and deliberation. The dual role serves as a bridge between management and the Board of Directors that enables Mr. Greenberg to provide his insight and direction on important strategic initiatives to both groups, ensuring that they act with a common purpose. As our founder and one of our largest stockholders, with beneficial ownership of approximately 53.3% of the aggregate number of votes eligible to be cast by our stockholders and the ability to exert significant influence over matters requiring approval by our stockholders, we believe Mr. Greenberg is the appropriate person to lead both our Board of Directors and the management of our company.

To further strengthen our corporate governance structure and provide independent oversight of our company, our Board of Directors appointed Morton Erlich as our Lead Independent Director for a five-year term, effective as of April 1, 2022. The Lead Independent Director acts as a liaison between the non-management directors on our Board and Robert Greenberg and the other members of our management team, chairs and presides over regularly held executive sessions without our management present, and performs other functions as requested by the non-management directors. Executive sessions are typically held in conjunction with regularly scheduled Audit Committee meetings and Board meetings, and additional sessions may be called by the Lead Independent Director in his own discretion or at the request of the Board of Directors.

Role of Board in Risk Oversight

Our Board of Directors is responsible for the oversight of risk management. The Board of Directors delegates much of this responsibility to the various committees of the Board. The Audit Committee is responsible for inquiring of management, our Vice President of Internal Audit and our independent registered public accounting firm about our financial reporting processes, internal controls and policies with respect to financial risk assessment and management. The Compensation Committee oversees risks related to our human capital and compensation programs and the Nominating and Governance Committee is responsible for reviewing regulatory and other ESG and corporate compliance risks. The Board is advised by the committees of significant risks and management’s response via periodic updates.

Audit Committee

Morton Erlich, Chairperson of the Audit Committee, and Zulema Garcia are “audit committee financial experts” as defined in Item 407(d)(5) of Regulation S-K under the Exchange Act. The Audit Committee is responsible for overseeing and evaluating (i) the quality and integrity of our financial statements, (ii) the performance of our internal audit and internal control functions in addition to financial risk assessment and management applicable to our company, (iii) our policies and procedures regarding transactions with related persons, as described in greater detail below in the section entitled “Transactions with Related Persons” in this proxy statement, (iv) the appointment, compensation, independence and performance of our independent registered public accounting firm, and (v) our compliance with legal and regulatory requirements.

Compensation Committee

The Compensation Committee is responsible for (i) discharging the Board’s responsibilities relating to compensation of our executive officers, (ii) overseeing the administration of our executive compensation plans, (iii) reviewing and discussing with our management the Compensation Discussion and Analysis required by the applicable SEC rules and recommending to the Board whether such disclosure should be included in our proxy statement, (iv) overseeing risks related to our compensation programs, (v) the appointment, compensation,

14

independence and performance of the Compensation Committee’s independent compensation advisor, and (vi) producing a report on executive compensation for inclusion in our proxy statement in accordance with the applicable rules of the SEC. This includes reviewing and approving the annual compensation of our Chief Executive Officer and other Named Executive Officers, reviewing and making recommendations to the Board with respect to executive compensation plans, including incentive compensation and equity-based compensation, and reviewing and approving performance goals and objectives with respect to the compensation of our Chief Executive Officer and other Named Executive Officers consistent with our executive compensation plans. Since 2020, the Compensation Committee has retained the services of an independent compensation advisor, FW Cook, to advise on certain matters related to executive compensation. After review and consultation with FW Cook, the Compensation Committee determined that FW Cook is independent and there is no conflict of interest resulting from retaining FW Cook pursuant to applicable SEC and NYSE rules. For additional information on the roles of FW Cook, our Chief Executive Officer and other members of management in recommending the form or amount of executive compensation, see “Compensation Discussion and Analysis—Oversight Responsibilities for Executive Compensation” in this proxy statement.

Compensation Committee Interlocks and Insider Participation. None of the members of our Compensation Committee has ever been an employee or officer of our company or any of its subsidiaries. None of the members of our Compensation Committee has had a transaction since January 1, 2023 involving our company with value in excess of $120,000 in which any related person had a direct or indirect material interest. None of our executive officers has served or currently serves on the board of directors or on the compensation committee of any other entity, which has officers who served on our Board of Directors or Compensation Committee during the fiscal year ended December 31, 2023.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for (i) developing and recommending to our Board of Directors the criteria for selecting directors and assessing director independence, (ii) identifying and recommending qualified candidates as director nominees for election to the Board, (iii) considering and making recommendations to the Board regarding its size and composition, director assignments as Lead Independent Director and to the other Board committees, the appointment of a chairperson for each of the Board committees, and committee structure, operations and reporting to the Board, (iv) overseeing the evaluation of our management, the Board and its committees, including, in consultation with the Compensation Committee, the performance evaluation of our Chairman and CEO against approved goals and objectives, (v) developing, reviewing and reassessing the corporate governance guidelines applicable to our company, (vi) reviewing, making recommendations and providing oversight with respect to our strategy, initiatives, policies and risks concerning environmental, social and governance matters, including significant issues of business ethics and corporate responsibility, and (vii) reviewing regulatory and other corporate compliance risks applicable to us.

Director Nominations

In the event of a vacancy on our Board of Directors, the Nominating and Governance Committee identifies and evaluates director candidates by seeking recommendations from our Board members, management and others, and meeting from time to time to evaluate potential candidates’ biographical information and qualifications and interviews of selected candidates by members of the committee and other directors. In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating and Governance Committee applies the criteria set forth in our Corporate Governance Guidelines. While the Nominating and Governance Committee has not established specific minimum qualifications for director nominees, the committee believes that candidates and nominees must comprise a board of directors who possess as a whole: personal and professional integrity, ethics and values; experience in corporate management and a general understanding of marketing, finance and other elements relevant to the success of a publicly traded company; experience in our company’s industry; and practical and mature business judgment, including the ability to make independent analytical inquiries. The committee considers the statutory requirements applicable to the composition of the Board and its committees, including independence requirements of the NYSE. Our Board of Directors ultimately determines the director nominees approved for inclusion on the proxy card for each annual meeting of stockholders.

15

Our Nominating and Governance Committee considers diversity when identifying and evaluating director nominees, and we believe that the backgrounds and qualifications of our directors, considered as a group, should provide a diverse mix of experience, knowledge and skills that will best allow our Board to fulfill its responsibilities including oversight of our business. Consistent with the committee’s charter, when identifying director nominees, the committee considers general principles of diversity and does so in the broadest sense. The committee considers diversity to include gender and ethnicity, age, skills and experience in the context of the needs of the Board as well as viewpoint, individual characteristics, qualities and skills resulting in the inclusion of varying perspectives among the directors. The committee also considers whether these capabilities and characteristics will enhance and complement the full Board of Directors so that, as a unit, the Board of Directors possesses the appropriate skills and experience to oversee our company’s business and serve the long-term interests of our stockholders. In particular, the committee considers gender and underrepresented group status when evaluating director nominees and has committed to including women and underrepresented candidates in the pool from which future candidates are selected. The Board of Directors currently includes three women and two members of underrepresented groups.

The Nominating and Governance Committee will consider candidates recommended by stockholders for nomination for election as directors. The committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying the same criteria, as it follows for candidates recommended by our Board members, management and others. Stockholders wishing to submit recommendations must provide the following information by written notice to the attention of our General Counsel by certified or registered mail:

• As to each person whom the stockholder proposes to recommend as a candidate for election as a director:

• the name, age, business address and residential address of the candidate;

• the principal occupation or employment of the person;

• the class and number of shares of our stock that are beneficially owned by the candidate; and

• the candidate’s consent to be named in the proxy statement as a nominee and to serve as a director if elected.

• As to the stockholder recommending a candidate for director:

• the name and address, as they appear on our stock transfer books, of the stockholder and of the beneficial owners, if any, of the stock registered in the stockholder’s name and the name and address of other stockholders known by the stockholder to be supporting the candidate; and

• the class and number of shares of our stock beneficially owned (i) by the stockholder and the beneficial owners, if any, and (ii) by any other stockholders known by the stockholder to be supporting such candidates.

To be considered for the 2025 Annual Meeting, nominations for director candidates must be received at our principal office within the time period set forth below under the section “Nominations and Stockholder Proposals for 2025 Annual Meeting” in this proxy statement. Stockholders are also advised to review our bylaws, which contain additional requirements with respect to nominations for director candidates.

Code of Business Conduct and Ethics and Corporate Code of Conduct

Our Code of Business Conduct and Ethics and our Corporate Code of Conduct, which applies to all directors, officers and employees, were adopted by our Board of Directors as of April 28, 2004 and are amended by the Board from time to time, including February 2024 with respect to the Code of Business Conduct and Ethics. The purpose of the Code of Business Conduct and Ethics and the Corporate Code of Conduct is to promote honest and ethical conduct. The Code of Business Conduct and Ethics and the Corporate Code of Conduct are posted in the Corporate Governance section of the Investor Relations page of our corporate information website located at https://investors.skechers.com/corporate-governance/governance-documents. We intend to promptly post any amendments to or waivers of the Code of Business Conduct and Ethics and the Corporate Code of Conduct on our website. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this proxy statement.

16

Stockholder Communications with the Board of Directors

Stockholders and other interested parties who wish to contact our Lead Independent Director, Morton Erlich, or any of our other directors either individually or as a group may do so by writing to them c/o Philip Paccione, Corporate Secretary, Skechers U.S.A., Inc., 228 Manhattan Beach Boulevard, Manhattan Beach, California 90266. Each writing should specify whether the communication is directed to our entire Board of Directors, to only the non-management directors or to a particular director. Copies of written communications received at such address will be provided to the Board of Directors or the relevant director unless such communications are considered, in the reasonable judgment of our Corporate Secretary, to be inappropriate for submission to the intended recipient(s). Examples of communications that would be considered inappropriate for submission to the Board of Directors include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to our company’s business or communications that relate to improper or irrelevant topics. The Corporate Secretary may analyze and prepare a response to the information contained in communications received and may deliver a copy of the communication to other staff members or agents of our company who are responsible for analyzing or responding to complaints or requests.

Compensation of Directors

The following table sets forth information concerning the compensation earned by our non-employee directors during 2023. Robert Greenberg, Michael Greenberg and David Weinberg, who are executive officers, did not earn any additional compensation for services provided as members of our Board of Directors.

Name |

|

Fees Earned or |

|

|

Stock Awards ($)(2) |

|

|

Total |

|

|||

Katherine Blair |

|

|

160,000 |

|

|

|

188,300 |

|

|

|

348,300 |

|

Morton Erlich |

|

|

225,000 |

|

|

|

188,300 |

|

|

|

413,300 |

|

Zulema Garcia |

|

|

125,000 |

|

|

|

188,300 |

|

|

|

313,300 |

|

Yolanda Macias |

|

|

125,000 |

|

|

|

188,300 |

|

|

|

313,300 |

|

Richard Siskind |

|

|

160,000 |

|

|

|

188,300 |

|

|

|

348,300 |

|

Non-Employee Directors. During 2023, we paid each of our non-employee directors annual compensation of $125,000 for serving on the Board of Directors. Our Lead Independent Director, Audit Committee Chairperson, Compensation Committee Chairperson and Nominating and Governance Committee Chairperson were paid additional annual fees of $50,000, $50,000, $35,000 and $35,000, respectively. Non-employee directors are also reimbursed for reasonable costs and expenses incurred for attending any of our Board or committee meetings and continuing education programs or seminars. During 2023, non-employee directors were eligible to receive awards of restricted shares of Class A Common Stock as determined by the Board of Directors. On June 9, 2023, each of our non-employee directors who was continuing to serve on our Board of Directors received an award of 3,500 restricted shares of Class A Common Stock under the 2017 Incentive Award Plan (the “2017 Plan”). The grant date fair value was $188,300, and the shares are scheduled to vest on May 1, 2026, subject to each director’s continued service through the vesting date.

17

Employee Directors. During 2023, Robert Greenberg, Michael Greenberg and David Weinberg were executive officers serving on our Board of Directors. Employees of Skechers, who are members of the Board of Directors, are not paid any directors’ fees or other compensation for their service on our Board of Directors. Compensation of Robert Greenberg, Michael Greenberg and David Weinberg earned in 2023 is set forth under “Executive Compensation—Summary Compensation Table.”

Stock Ownership Policy for Non-Employee Directors

Our Compensation Committee believes that, in order to more closely align the interests of our non-employee directors with the interests of our executive officers and other stockholders, all non-employee directors should maintain a minimum level of equity interests in our company’s Class A Common Stock. Our Board of Directors authorized and approved a stock ownership policy, effective as of April 1, 2022, requiring our non-employee directors to maintain stock ownership equal to three times their annual cash retainer under this policy. Each current non-employee director has until December 31, 2027 to come into compliance with this policy. Any newly appointed member of the Board shall come into compliance with this policy by December 31 of the year in which the fifth anniversary of his or her appointment date occurs. After the applicable compliance deadline, until an individual meets his or her stock ownership requirement, the after-tax portion of all equity awards that we grant to such individual must be held until he or she is in compliance with this policy.

18

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) discusses our compensation policies and determinations that apply to our Named Executive Officers. When we refer to our Named Executive Officers, we are referring to the following individuals whose 2023 compensation is described below and set forth below in the Summary Compensation Table (“SCT”) and subsequent compensation tables (the “Named Executive Officers” or “NEOs”).

The CD&A contains certain forward-looking statements that are based on considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we may adopt in the future may differ materially from the compensation strategy, philosophy, policies, programs and practices summarized in this discussion.

Name |

|

Position |

Robert Greenberg |

|

Chief Executive Officer |

John Vandemore |

|

Chief Financial Officer |

Michael Greenberg |

|

President |

David Weinberg |

|

Chief Operating Officer |

Mark Nason |

|

Executive Vice President of Product Development |

Executive Summary

For the year ended December 31, 2023, compared to the year ended December 31, 2022, sales increased 7.5% to $8.0 billion, a new annual record including four consecutive quarterly sales records. Gross margins improved to 51.9% and inventory was reduced by 16.1%. Our financial results reflect the significant market demand for our product offerings and the value that we provide.

We believe brand recognition is paramount to continued success. We drive awareness and demand through comprehensive marketing campaigns. During the year, we introduced partnerships and a capsule collection with Martha Stewart and Snoop Dogg. Skechers Performance signed Harry Kane, Europe’s top goal scorer for 2023, as well as other premier players for the launch of Skechers Football, and New York Knicks all-star Julius Randle and Los Angeles Clippers Terance Mann, who both compete in Skechers Basketball.

2023 Business Highlights

Highlights of our performance include:

19

Key 2023 Compensation Actions

The primary elements of our compensation program for the Named Executive Officers and a summary of the actions taken by the Compensation Committee during 2023 are set forth below.

Compensation Component |

|

Link to Business and Talent Strategies |

|

2023 Compensation Actions |

Base Salary (Page 24) |

|

• Base salaries reflect contribution, background, knowledge, skills, experience and performance. |

|

• Our Compensation Committee approved merit-based increases for our NEOs, ranging from 5% to 9%, commensurate with the performance of our company and individual accomplishments. |

|

|

|

|

|

Annual Incentive Compensation (Page 25) |

|

• Annual cash incentives based on the achievement of our financial goals. |

|

• Our Compensation Committee approved the performance criteria, formula and percentages to be used to determine the Named Executive Officers’ incentive compensation. |

|

|

|

|

|

Long-Term Incentive Compensation (Page 26) |

|

• Aligns Named Executive Officers’ interests with long-term interests of stockholders and are based on the achievement of financial and strategic objectives. |

|

Our Compensation Committee granted to the Named Executive Officers: • Restricted stock awards with time-based vesting, and • Performance-based restricted stock awards (“PSAs”) with vesting based upon the achievement of pre-established EPS growth for each year of a 3-year performance period and 3-year relative TSR. |

2023 Say-On-Pay Vote

At our 2017 and 2023 annual meetings of stockholders, our stockholders recommended, and the Board of Directors determined, that the stockholder advisory votes on the compensation of our Named Executive Officers would occur on a triennial basis. Accordingly, we held an advisory “say-on-pay” vote in 2023, in which approximately 72% of votes cast were in support of our pay practices. In its compensation review process, the Compensation Committee considers whether our executive compensation program is aligned with the interests of its stockholders. In that respect, as part of its review of our executive compensation program, the Compensation Committee considered the approval by approximately 72% of the votes cast for our advisory say-on-pay vote at our 2023 annual meeting of stockholders. We expect that the next say-on-pay vote, after the Annual Meeting, will be held at our 2026 annual meeting of stockholders.

For 2023, the Compensation Committee determined that our executive compensation philosophies and objectives, and compensation elements continued to be appropriate, including the changes that were made to our long-term incentive program with the introduction of performance-based restricted stock awards in 2020 to better align the Named Executive Officers’ interests with the long-term interests of stockholders based on the achievement of specific performance goals. The Compensation Committee will continue to regularly review, assess and, when appropriate, adjust our executive compensation program in response to stockholder feedback.

As discussed in greater detail in the discussion under “Long-Term Incentive Program,” the performance-based restricted stock awards that were awarded as part of the Named Executive Officers’ compensation in 2023 consisted of two equally weighted performance metrics:

20

2023 Compensation Snapshot

Based on the foregoing, our 2023 executive compensation program can be summarized as follows:

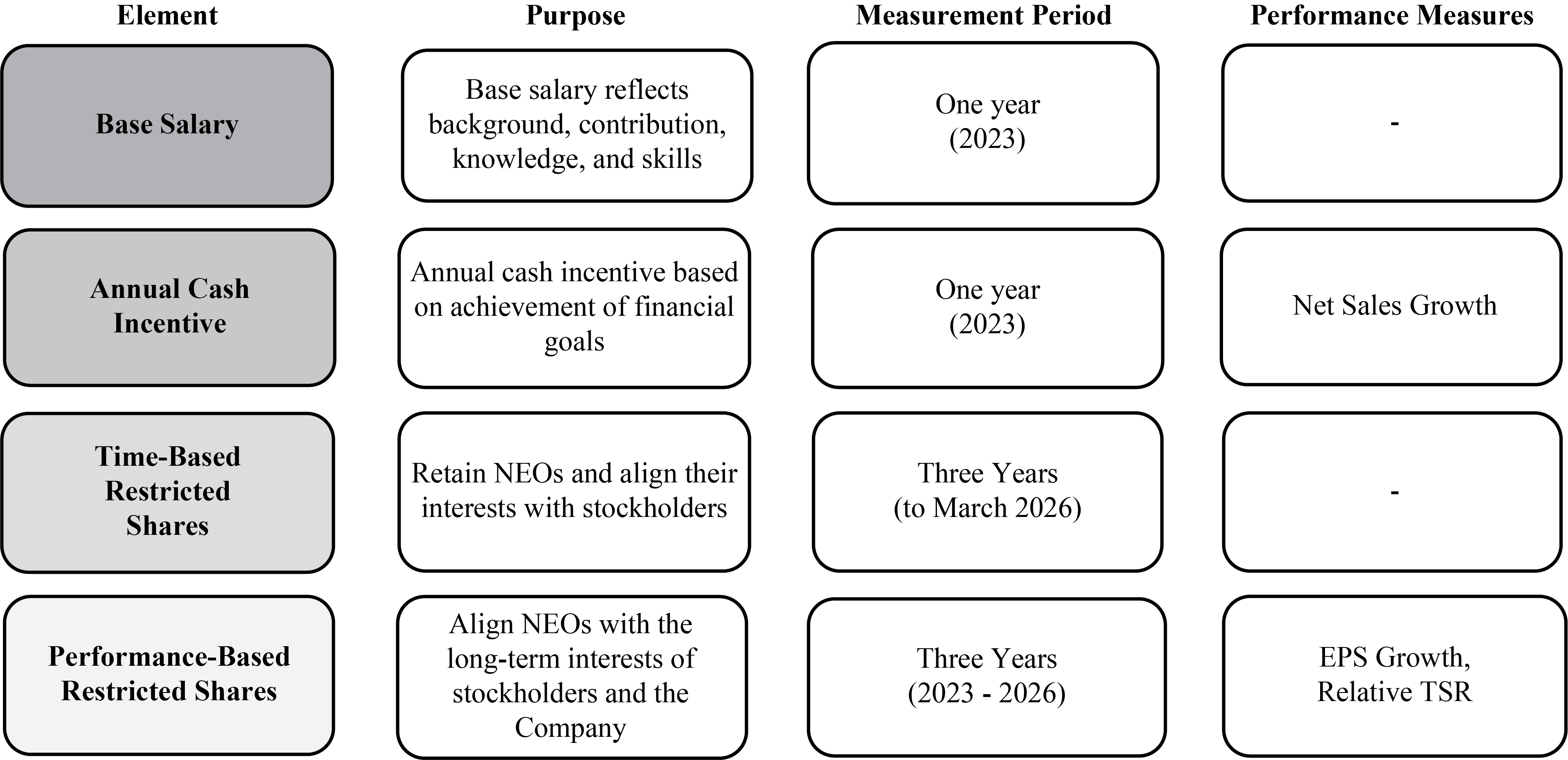

Base Salary Base salary reflects backgroung, contribution, knowledge, and skills One year (2023) - Annual Cash Incentive Annual cash incentive based on achievement of financial goals One year (2023) Net Sales Growth Time-Based Restricted Shares Retain NEOs and align their interests with stockholders Three Years (to March 2026) - Performance-Based Restricted Shares Align NEOs with the long-term interests of stockholders and the Company Three Years (2023 - 2026) EPS Growth, Relative TSR

21

Executive Compensation Practices

The Compensation Committee reviews on an ongoing basis our executive compensation program to evaluate whether it supports our executive compensation philosophies and objectives and is aligned with stockholder interests. Our executive compensation practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

✓ |

Pay for performance by structuring a significant percentage of target annual compensation in the form of variable, at-risk compensation |

×

× |

We do not have excise tax gross-ups

We do not allow payment of dividends or dividend equivalents on unearned performance-based awards |

|

|

|

|

✓ |

Pre-established performance goals that are aligned with creation of stockholder value |

×

|

We do not allow repricing of underwater stock options without stockholder approval |

|

|

|

|

✓ |

Market comparison of executive compensation against a relevant peer group |

|

|

|

|

|

|

✓ |

Use of an independent compensation consultant reporting directly to the Compensation Committee and providing no other services to our company |

|

|

|

|

|

|

✓ |

Clawback policy |

|

|

|

|

|

|

✓ |

Robust stock ownership policy |

|

|

How We Determine Executive Compensation

Our Executive Compensation Philosophy and Objectives

The basic compensation philosophy of the Compensation Committee is to provide competitive salaries and incentives to executive officers in order to promote superior financial performance. The Compensation Committee believes that compensation paid to executive officers should be closely aligned with our performance, linked to specific, measurable results intended to create value for stockholders, and that such compensation should assist us in attracting and retaining key executives critical to our long-term success.

Our executive compensation policies are designed to achieve the following four objectives:

Consistent with our performance-based philosophy, the Compensation Committee reviewed and approved our compensation programs for 2023 to effectively balance executive officers’ salaries with performance-based incentive compensation. We believe that it served the needs of our stockholders to provide incentives commensurate with individual management responsibilities as well as past and future contributions to corporate objectives. The mix of compensation elements varied among the executive officers based on each executive officer’s position, responsibilities, experience, and performance.

22

To maximize stockholder value, we believe that it is necessary to deliver consistent, long-term sales and earnings growth. Accordingly, the Compensation Committee reviews not only the individual compensation elements, but the mix of individual compensation elements that make up the aggregate compensation, and attempts to balance the total compensation package between short-term, long-term and cash and equity compensation in a way that meets the objectives set forth above.

Oversight Responsibilities for Executive Compensation

The table below summarizes the key oversight responsibilities for executive compensation.

Compensation Committee |

• Establishes executive compensation philosophy • Approves incentive compensation programs and target performance expectations for the annual incentive compensation plan and long-term incentive compensation awards • Approves all compensation actions for the Named Executive Officers, including (i) base salary, (ii) target performance criteria and formulae, and actual compensation, under the annual incentive compensation plan, and (iii) long-term incentive compensation awards

|

|

|

Nominating & Governance Committee |

• Working with the Compensation Committee and after careful evaluation of the performance of the business, evaluates the performance of the Chief Executive Officer

|

|

|

Independent Committee Consultant—FW Cook |

• Provides independent advice, research, and analytical services on a variety of subjects to the Compensation Committee, including compensation of executive officers and non-employee directors, and executive compensation trends • Participates in Compensation Committee meetings as requested and communicates with the Chair and other members of the Compensation Committee between meetings • Reports to the Compensation Committee, does not perform any other services for our company, and has no economic or other ties to our company or the management team that could compromise its independence or objectivity • The Compensation Committee considered the independence of FW Cook under applicable SEC rules and listing requirements and determined that FW Cook is independent and that its engagement by the Compensation Committee did not raise any conflict of interest

|

|

|

Chief Executive Officer and Management |

• Management, including the Chief Executive Officer, develops preliminary recommendations regarding compensation matters with respect to all Named Executive Officers, and provides these recommendations to the Compensation Committee, which makes the final decisions outside the presence of the Chief Executive Officer, with advice from FW Cook, as appropriate • Responsible for the administration of the compensation programs once Compensation Committee decisions are finalized |

Peer Group Selection and Market Data

To obtain a broad view of competitive practices among industry peers and competitors for executive talent, the Compensation Committee reviews market data for peer group companies as well as a general industry survey data. Since 2020, the Compensation Committee has retained the services of a compensation consultant, FW Cook, to advise on certain matters related to executive compensation. As a result, our company formally established a peer group of companies that has been used as a reference point to assess the competitiveness of base salary, incentive

23

targets, and total direct compensation awarded to the Named Executive Officers and as information on market practices including incentive design, share utilization, and share ownership guidelines.

For the equity awards granted to certain officers in March 2023, the Compensation Committee utilized the peer group set forth below:

Peer Group |

||

Capri Holdings |

|

Lululemon Athletica |

Carter's |

|

Mattel |

Columbia Sportswear |

|

PVH Corp. |

Deckers Outdoor |

|

Ralph Lauren |

G-III Apparel Group |

|

Tapestry |

Hanesbrands |

|

Under Armour |

Hasbro |

|

Wolverine World Wide |

Levi Strauss |

|

|

Based on data compiled by FW Cook as of 2022 year-end (in advance of setting the Named Executive Officers' compensation levels for 2023), our revenues, net earnings, and market capitalization were at the 93rd, 48th and 59th percentiles, respectively, in relation to the peer group.

2023 Named Executive Officer Compensation

Base Salary

Base salaries for our Named Executive Officers are established based on the scope of their respective experience and responsibilities. We set base compensation for our Named Executive Officers at levels that we believe enable us to hire and retain individuals in a competitive environment, and to reward satisfactory performance at an acceptable level based upon contributions to our overall business objectives.

Base salaries are generally reviewed annually, but may be adjusted from time to time to realign salaries with market levels. In reviewing base salaries, we consider various factors, including each individual’s level of responsibilities, performance and results achieved, and professional experience, and cost of living increases.

Name of Executive |

|

2022 Base |

|

|

Increase (%) |

|

|

2023 Base |

|

|||

Robert Greenberg |

|

|

6,200,000 |

|

|

|

5 |

% |

|

|

6,510,000 |

|

John Vandemore |

|

|

1,500,000 |

|

|

|

5 |

% |

|

|

1,570,000 |

|

Michael Greenberg |

|

|

5,025,000 |

|

|

|

5 |

% |

|

|

5,270,000 |

|

David Weinberg |

|

|

3,665,000 |

|

|

|

5 |

% |

|

|

3,840,000 |

|

Mark Nason |

|

|

2,350,000 |

|

|

|

9 |

% |

|

|

2,550,000 |

|

Annual Incentive Plan

The 2006 Annual Incentive Compensation Plan (the “2006 Plan”) is intended to advance our interests and those of our stockholders and to assist us in attracting and retaining executive officers by providing incentives and financial rewards to such executives who, because of the extent of their responsibilities can make significant contributions to our success through their ability, industry expertise, loyalty and exceptional services.

The 2006 Plan provides executive employees, including the Named Executive Officers, with the opportunity to earn bonuses based on our financial performance by linking incentive award opportunities to the achievement of our short-term performance goals. The 2006 Plan allows us to set performance periods equal to quarters, years or such other period that the Compensation Committee may establish up to five years in length, and determine performance criteria and goals for such performance periods that are flexible and change with the needs of our business. The Compensation Committee annually approves the performance criteria and goals that will be used in the formula to calculate our Named Executive Officers’ incentive compensation on a quarterly basis for each year. By determining performance criteria and setting goals at the beginning of each year, our Named Executive Officers understand our goals and priorities during the current year. Following the conclusion of each quarter during the

24

current year, the Compensation Committee certifies the amount of the award for each participant for each such quarter. The amount of an award actually paid to a participant each quarter may, in the sole discretion of the Compensation Committee, be reduced to less than the amount payable to the participant based on attainment of the performance goals for each such quarter.

The Compensation Committee did not place a maximum limit on the incentive compensation that could have been earned by the Named Executive Officers in 2023, although the maximum amount of incentive compensation that any Named Executive Officer may earn in a 12-month period under the 2006 Plan is $10,000,000.